- General Info

- Demographics

- Education and Employment

- Valuation and Taxes Levied

- State Senators

- History

- County Programs

- Other Information

Communities and Development

Keya Paha County Seat: Springview

Total County Population: 769

- Villages (pop.): Burton (11), Springview (238)

- Unincorporated Pop. (% of county pop.): 520 (68%) 2020

Land Development (% of total land in county):

- Agriculture: 97%

- By method: Pasture (pure grassland) (84%); Dryland (row crop/grain/forage) (7%); Irrigated (row crop/grain/forage) (6%) • Neb. Dept. of Rev. - total equals agriculture's %

- By commodity: Livestock (grassland) 71%, Corn 4%, Alfalfa 3%, Soybeans 1% • USDA - equals agriculture's % plus some wetlands (8%) and wooded grazing land (8%) and and minus public grassland/wetlands and reserve

- Residential, Commercial, Industrial, Conservation Reserve & Exempt (combined): 3% 2022

County Offices

Courthouse Address and Hours:

310 Courthouse Dr.

Springview, NE 68778

8:00 am - 12:00 pm; 1:00 pm - 5:00 pm

Complete list of county board members

County Board Meetings: Wednesday

View the County's Government Maps

NACO District: Northeast

General

Population: 769

Land area (sq. mi.): 773.08

Population per square mile: 1.0

Age and Race

Race 2020

White: 95.4%

African American: 0.0%

American Indian: 0.1%

Asian: 0.0%

Hispanic: 2.6%

Native Hawaiian and Pacific Islander: 0.0%

Two or More Races: 1.8%

Age 2020

0-17: 18.3%

18-64: 49.8%

65+: 31.9%

Households

Total households: 353 2020

With one child: 20 2022

With 2+ children: 40 2022

With seniors (65+): 120 2022

Socioeconomics

Median household income: $60,313 2023

% of Population in Poverty: 20.9% 2023

# of Housing Units: 496 2020

Owner-occupied rate: 81.3% 2020

Median home price: $117,680 Q4 2024

2024 building permits for detached single family homes: 0

2024 building permits for non-detached housing units: 0 (townhouse, duplex, or apt. unit)

Technology

Access to broadband (100 Mbps via fiber or cable modem): 96.3% 2021

Sources: National Association of Realtors, Nebraska Department of Revenue, Nebraska Legislature, Nebraska Library Commission, U.S. Bureau of Economic Analysis, U.S. Census Bureau (building permits), U.S. Census Bureau (demographics), U.S. Census Bureau (municipalities)

Employment, Schools, and Child Care

Unemployment rate: 3.0% March 2025

County Employment Website: https://co.keya-paha.ne.us/webpages/links/public_notices.html

High school graduate or higher: 95.7% 2020

School District: Keya Paha County Public Schools

Bachelor's degree or higher: 25.5% 2020

Community College Service Area: Northeast Community College

Keya Paha County Economy

Annual Gross Domestic Product (GDP): $47,295,000 2023

Nonfarm Small Business Receipts: $10,568,884 2022

Nonfarm Wage Income: $10,092,000 2022

Farm and Ranch Commodity Sales Receipts: $76,378,000 2022

Farm and Ranch Operations (Non-Sales) Receipts: $1,852,000 2022

- For components of nonfarm small business receipts, nonfarm wage income, and farm & ranch commodity sales and operations receipts, see "Notes" below.

Grain Elevators by Location (bushel capacity):

- Springview: CVA (35,000)

- (1 bushel = 56 lbs. corn/sorghum, 60 lbs. soybeans/wheat; % max. moisture = 18% beans, 15.5% corn, 14% sorghum/soybeans, 13.5% wheat)

Local Grain Market: Click for today's grain prices in Keya Paha County

Cattle Producers: 171

Crop Producers: 57

- Irrigated Land Cash Rent (avg.): $197/acre 2024

Electricity Providers: Cherry-Todd Electric Coop., KBR Rural PPD

Wind Turbines Operating (MW): 2 turbines (3,000 MW)

Irrigation and Drinking Water

Rural Irrigation Wells: 373 2024

Rural Livestock Wells: 339 2024

Rural Commercial/Industrial Wells: 0 2024

Rural Drinking Water Wells: 96 2024

Drinking Water Utility Connections: 162 Residential; 19 Commercial; 0 Industrial 2024

Surface Water Diversions (Irrigation): 99 2024

Click for real time:

Streamflow data on the Niobrara River at NE Hwy 137 bridge (21 mi. east of Springfield)

Notes

Keya Paha County Economy

- Nonfarm small business receipts are reported by partnerships and sole proprietorships. They do not include receipts reported by cooperative associations.

- Nonfarm wage income is reported based upon the wage earner's residential address; therefore, it also includes wages earned by Keya Paha County residents in other counties or states, but it excludes wages earned in Keya Paha County by residents of other counties or states.

- Nonfarm wage income excludes wages earned by anyone claimed as a dependent.

- Farm and ranch commodity sales receipts and operations receipts are reported based upon the farm or ranch owner's principal county of operations; therefore, those figures also include receipts reported by producers operating principally in Keya Paha County for their production in other counties or states, but the figures exclude receipts reported for production in Keya Paha County by producers operating principally in other counties or states.

Irrigation and Drinking Water

- A rural irrigation well is any well intended for irrigating crops that, either on its own or as part of a set of commingled wells, is capable of pumping more than fifty (50) gallons of water per minute (gpm). Note that some rural commercial/industrial wells are also capable of pumping more than 50 gpm. In Nebraska, the owner of any well--or set of commingled wells--that is capable of pumping more than 50 gpm must register the well(s) with the state government and have a permit for the well(s) from the local natural resource district (NRD).

- Rural livestock wells and rural drinking water (also known as "domestic") wells are not allowed to pump more than 50 gpm unless permitted by the local NRD. Each rural drinking water well usually serves one single family home, though in rare cases a rural drinking water well serves multiple homes.

- Data on rural livestock wells and rural drinking water wells may be incomplete for wells drilled prior to September 9, 1993. State law does not require wells drilled prior to that date to be registered with the state government if the wells are not capable of pumping more than 50 gpm. Neb. Rev. Stat. § 46-735; see Laws 1993, LB 131, § 25.

Sources: National Agricultural Statistics Service (USDA), Nebraska Cooperative Council, Nebraska Coordinating Commission for Postsecondary Education, Nebraska Department of Health and Human Services, Nebraska Department of Revenue, Nebraska Department of Transportation, Nebraska Office of the CIO, Nebraska Power Review Board, Nebraska Public Service Commission, U.S. Bureau of Economic Analysis, U.S. Bureau of Labor Statistics, U.S. Census Bureau, U.S. Energy Information Administration, U.S. Department of the Treasury (IRS), Warehouse and Commodity Management Division (USDA)

2024 Levies and Valuation

County levy rate: $0.1910 per $100 of taxable valuation

County property taxes levied: $1,135,329

Total local government property taxes levied: $4,084,516

Total countywide taxable valuation: $594,339,790

Click here for all levy rates in Keya Paha County

County Levy and Taxation Laws

Levy limits

Since 1996, counties and other political subdivisions have been subject to the levy limits listed in Neb. Rev. Stat. § 77-3442 and Neb. Rev. Stat. § 77-3443.

Statutes and regulations

Nebraska Revised Statutes (Chapter 77)

Nebraska Administrative Code (Title 350)

Local tax reductions, exemptions, and credits

Neb. Rev. Stat. § 76-902(5)(a) (Deed "stamp tax" exemption): "The [stamp tax] shall not apply to: ... (5)(a) Deeds between spouses, between ex-spouses for the purpose of conveying any rights to property acquired or held during the marriage, or between parent and child, without actual consideration therefor."

Neb. Rev. Stat. § 77-201(2) (Valuation of agricultural land and horticultural land): "Agricultural land and horticultural land as defined in section 77-1359 shall constitute a separate and distinct class of property for purposes of property taxation, shall be subject to taxation, unless expressly exempt from taxation, and shall be valued at seventy-five percent of its actual value, except that for school district taxes levied to pay the principal and interest on bonds that are approved by a vote of the people on or after January 1, 2022, such land shall be valued at fifty percent of its actual value."

Neb. Rev. Stat. § 77-6703(1) (Tax credit for school district taxes paid): "(1) For taxable years beginning or deemed to begin on or after January 1, 2020, under the Internal Revenue Code of 1986, as amended, there shall be allowed to each eligible taxpayer a refundable credit against the income tax imposed by the Nebraska Revenue Act of 1967 or against the franchise tax imposed by sections 77-3801 to 77-3807. The credit shall be equal to the credit percentage for the taxable year, as set by the department under subsection (2) of this section, multiplied by the amount of school district taxes paid by the eligible taxpayer during such taxable year."

Sources: Nebraska Department of Revenue

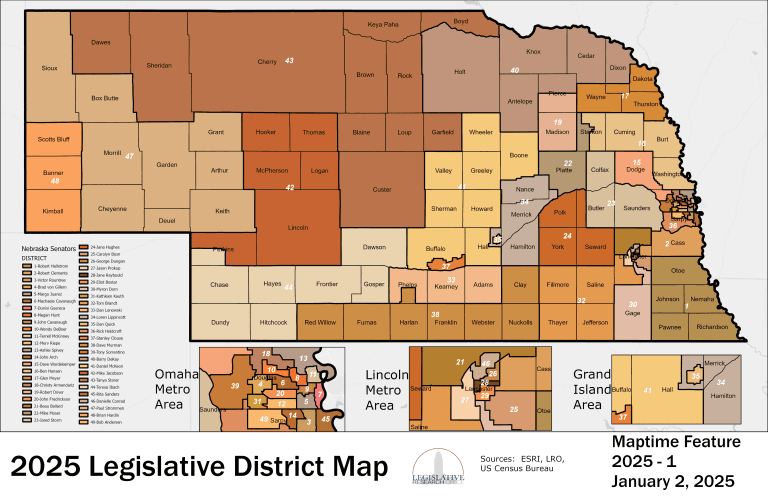

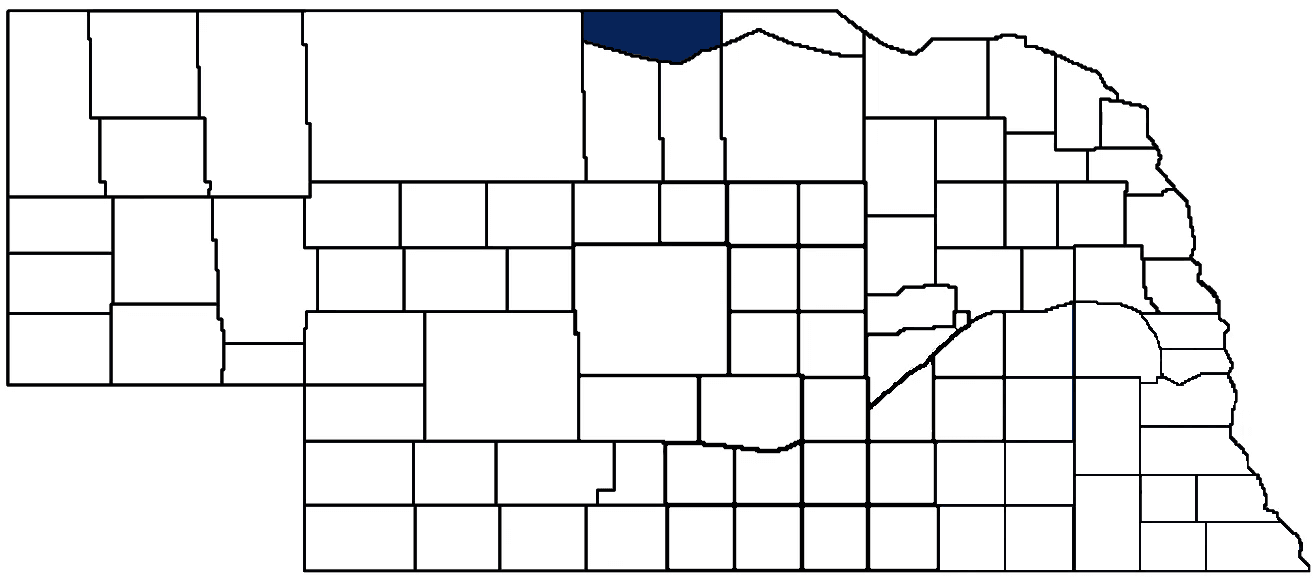

State Senator: Tanya Storer(District 43)

Committees

Map and statistics for Legislative District 43

Map of all districts in the Nebraska Unicameral Legislature

Keya Paha County History

Number of Registered Historic Places: 2

Year Authorized: 1884

Year Organized: 1884

Etymology: Dakota for "turtle hill"

Boasting one of Nebraska’s most unique county names, Keya Paha County was once part of a larger county that also encompassed Brown and Rock County. The area was blessed with abundant buffalo and antelope, which attracted many Native American tribes (including the Pawnee and Ponca) who inhabited the area for hundreds of years before European settlers arrived. The territory features small, rounded hills that could be perceived as giant turtle shells, and historians believe the county’s name is derived from “Ké-ya Pa-há,” a Native American phrase meaning “turtle hill.”

In 1884, residents passed a petition to separate from Brown County and form a new county from the land north of the Niobrara River (in 1888, Rock County would separate from Brown County). While establishing Keya Paha County was simple, establishing a county seat proved more complicated. Nearly every community in the county fought for the honor of county seat, and even a committee tasked with the matter could not make a decision. An election would decide the contentious issue. In January of 1885, residents selected Springview and Burton as the two finalists from fifteen candidates. Two months later, the more centrally located Springview won the county seat by a slim margin of victory. Springview, named for a spring of water that once flowed through the northwest part of town, immediately began selling lots to build the county courthouse. In 1886, the courthouse was built and lasted until 1915, when the current courthouse was constructed.

Keya Paha County remains a tightly knit ranching community, and many Keya Paha residents can trace their ancestry back to some of the first families who founded the county. Since 1900, the county has hosted a summer barn dance that draws attendees from around Nebraska and other states. The historic Norden Dance Hall, built in 1929, is one of the county’s main activity hubs.

Keya Paha County Excellence

Local Highlights

License Plate Number: 82

Time Zone: Central

Number of Veterans: 57 2023

Zoned County: Yes

County Library: Keya Paha County Library

Number of County-Owned Bridges: 15

Election Data

General Election Turnout: 86% 2024

Total Registered Voters: 632 2024

Number of Precincts: 3 2022

Number of Election Day Polling Places: 1 2022

Land Area per Polling Place: 773.92 sq. miles

Intergovernmental Data

Emergency Mgt. Planning, Exercise and Training (PET) Region: North Central/Sandhills

Natural Resource Districts: Lower Niobrara NRD, Middle Niobrara NRD

State Lands (acres): Cub Creek Recreation Area (304), Holt Creek WMA (159.30), Thomas Creek WMA (1,154.50)

Sources: Nebraska Department of Transportation, Nebraska Emergency Management Agency, Nebraska Game & Parks Commission, Nebraska Legislature, Nebraska Office of the CIO, Nebraska Secretary of State, U.S. Department of Veterans Affairs, U.S. Election Assistance Commission, U.S. National Archives and Records Administration (eCFR)