- General Info

- Demographics

- Education and Employment

- Valuation and Taxes Levied

- State Senators

- History

- County Programs

- Other Information

Communities and Development

Butler County Seat: David City

Total County Population: 8,369

- Cities (pop. & class): David City (2,995 • 2nd Class)

- Villages (pop.): Abie (65), Bellwood (407), Brainard (336), Bruno (95), Dwight (229), Garrison (55), Linwood (94), Octavia (107), Rising City (356), Surprise (37), Ulysses (196)

- Unincorporated Pop. (% of county pop.): 3,397 (41%) 2020

Land Development (% of total land in county):

- Agriculture: 86%

- By method: Dryland (row crop/grain/forage) (39%); Irrigated (row crop/grain/forage) (36%); Pasture (pure grassland) (11%) • Neb. Dept. of Rev. - total equals agriculture's %

- By commodity: Corn 41%, Soybeans 33%, Livestock (grassland) 12%, Alfalfa 2%, Other Hay 1% • USDA (NLCD) - equals agriculture's % plus some wetlands (1%) and minus public grassland/wetlands and reserve

- Residential, Commercial, Industrial, Conservation Reserve & Exempt (combined): 9%

- Timber: 5% 2022

County Offices

Courthouse Address and Hours:

451 North 5th Street

David City, Nebraska 68632

M-F 8:30 am - 5:00 pm

Complete list of county board members

County Board Meetings: 1st & 3rd Monday

View the County's Government Maps

NACO District: Southeast

General

Population: 8,369

Land area (sq. mi.): 584.89

Population per square mile: 14.3

Race & Age

Race 2020

White: 91.1%

African American: 0.3%

American Indian: 0.3%

Asian: 0.1%

Hispanic: 5.8%

Native Hawaiian and Pacific Islander: 0.0%

Two or More Races: 2.1%

Age 2020

0-17: 24.0%

18-64: 55.2%

65+: 20.7%

Households

Total households: 3,424 2020

With one child: 430 2022

With 2+ children: 590 2022

With seniors (65+): 1,020 2022

Socioeconomics

Median household income: $82,603 2023

% of Population in Poverty: 8.7% 2023

# of Housing Units: 4,028 2020

Owner-occupied rate: 76.1% 2020

Median home price: $179,240 Q4 2024

2024 building permits for detached single family homes: 3

2024 building permits for non-detached housing units: 0 (townhouse, duplex, or apt. unit)

Technology

Access to broadband (100 Mbps via fiber or cable modem): 53.1% 2021

Sources: National Association of Realtors, Nebraska Department of Revenue, Nebraska Legislature, Nebraska Library Commission, U.S. Bureau of Economic Analysis, U.S. Census Bureau (building permits), U.S. Census Bureau (demographics), U.S. Census Bureau (municipalities)

Employment, Schools, and Child Care

Unemployment rate: 2.1% March 2025

County Employment Website: https://butlercountyne.gov/webpages/employment/employment.html

High school graduate or higher: 92.4% 2020

School Districts: Centennial Public Schools, Columbus Public Schools, David City Public Schools, East Butler Public Schools, Raymond Central Public Schools, Seward Public Schools, Shelby-Rising City Public Schools

Bachelor's degree or higher: 23.7% 2020

Community College Service Area: Central Community College

Countywide child care capacity: 11 providers; 306 children 2024

Find child care: For a list of child care providers in your zip code, visit Nebraska DHHS or the Nebraska Resource and Referral System.

Butler County Economy

Annual Gross Domestic Product (GDP): $564,872,000 2023

Nonfarm Small Business Receipts: $66,973,732 2022

Nonfarm Wage Income: $184,891,000 2022

Farm and Ranch Commodity Sales Receipts: $634,530,000 2022

Farm and Ranch Operations (Non-Sales) Receipts: $19,355,000 2022

- For components of nonfarm small business receipts, nonfarm wage income, and farm & ranch commodity sales and operations receipts, see "Notes" below.

Grain Elevators by Location (bushels capacity):

- Bellwood: Frontier (2,300,000)

- Brainard: Frontier (2,316,819)

- Bruno: Frontier (445,585)

- David City: Frontier (3,894,711)

- Garrison: Frontier (2,259,407)

- Rising City: CVA (2,810,000)

- Ulysses: CVA (2,120,000)

- (1 bushel = 56 lbs. corn/sorghum, 60 lbs. soybeans/wheat; % max. moisture = 18% beans, 15.5% corn, 14% sorghum/soybeans, 13.5% wheat)

Railroad Miles: 78.03 main, 8.13 side

- Places with Railroad Service: Bellwood, Brainard, David City, Garrison, Rising City

Local Grain Market: Click for today's grain prices in Butler County

Cattle Producers: 215

- Pastureland Cash Rent (avg.): $55/acre/yr 2024

Crop Producers: 235

- Dryland Land Cash Rent (avg.): $222/acre/yr 2024

- Irrigated Land Cash Rent (avg.): $295/acre/yr 2024

Dairy Producers: 2

Farmers Markets:

- David City Farmers Market ( May - October, 4 - 6 p.m.)

Electricity Providers: Butler PPD, City of David City, Polk County Rural PPD, Village of Brainard

Wind Turbines Operating (MW): 1 turbine (MW unknown)

Notes

- Nonfarm small business receipts are reported by partnerships and sole proprietorships. They do not include receipts reported by cooperative associations.

- Nonfarm wage income is reported based upon the wage earner's residential address; therefore, it also includes wages earned by Burt County residents in other counties or states, but it excludes wages earned in Burt County by residents of other counties or states.

- Nonfarm wage income excludes wages earned by anyone claimed as a dependent.

- Farm and ranch commodity sales receipts and operations receipts are reported based upon the farm or ranch owner's principal county of operations; therefore, those figures also include receipts reported by producers operating principally in Burt County for their production in other counties or states, but the figures exclude receipts reported for production in Burt County by producers operating principally in other counties or states.

Irrigation, Drinking Water, and Soils

Rural Irrigation/Livestock Wells: 1,531 2024

Rural Commercial/Industrial Wells: 11 2024

Rural Drinking Water Wells: 662 2024

Drinking Water Utility Connections: 2,083 Residential; 271 Commercial; 6 Industrial 2024

Irrigation/Livestock Wells per Square Mile: 3.91 2024

Surface Water Diversions (Irrigation): 93 2024

Click for real time:

Groundwater level data 2.5 mi. north of Rising City

Groundwater level data 3.5 mi. northeast of Rising City

Sources: National Agricultural Statistics Service (USDA), Nebraska Cooperative Council, Nebraska Coordinating Commission for Postsecondary Education, Nebraska Department of Health and Human Services, Nebraska Department of Revenue, Nebraska Department of Transportation, Nebraska Office of the CIO, Nebraska Power Review Board, Nebraska Public Service Commission, U.S. Bureau of Economic Analysis, U.S. Bureau of Labor Statistics, U.S. Census Bureau, U.S. Energy Information Administration, U.S. Department of the Treasury (IRS), Warehouse and Commodity Management Division (USDA)

2024 Levies and Valuations

County levy rate: $0.1774 per $100 of taxable valuation

County property taxes levied: $5,086,093

Total local government property taxes levied: $33,191,318

Total countywide taxable valuation: $2,867,195,690

Click here for all levy rates in Butler County

County Levy and Taxation Laws

Levy limits

Since 1996, counties and other political subdivisions have been subject to the levy limits listed in Neb. Rev. Stat. § 77-3442 and Neb. Rev. Stat. § 77-3443.

Statutes and regulations

Nebraska Revised Statutes (Chapter 77)

Nebraska Administrative Code (Title 350)

Local tax reductions, exemptions, and credits:

Neb. Rev. Stat. § 76-902(5)(a) (Deed "stamp tax" exemption): "The [stamp tax] shall not apply to: ... (5)(a) Deeds between spouses, between ex-spouses for the purpose of conveying any rights to property acquired or held during the marriage, or between parent and child, without actual consideration therefor."

Neb. Rev. Stat. § 77-201(2) (Valuation of agricultural land and horticultural land): "Agricultural land and horticultural land as defined in section 77-1359 shall constitute a separate and distinct class of property for purposes of property taxation, shall be subject to taxation, unless expressly exempt from taxation, and shall be valued at seventy-five percent of its actual value, except that for school district taxes levied to pay the principal and interest on bonds that are approved by a vote of the people on or after January 1, 2022, such land shall be valued at fifty percent of its actual value."

Neb. Rev. Stat. § 77-6703(1) (Tax credit for school district taxes paid): "(1) For taxable years beginning or deemed to begin on or after January 1, 2020, under the Internal Revenue Code of 1986, as amended, there shall be allowed to each eligible taxpayer a refundable credit against the income tax imposed by the Nebraska Revenue Act of 1967 or against the franchise tax imposed by sections 77-3801 to 77-3807. The credit shall be equal to the credit percentage for the taxable year, as set by the department under subsection (2) of this section, multiplied by the amount of school district taxes paid by the eligible taxpayer during such taxable year."

Sources: Nebraska Department of Revenue

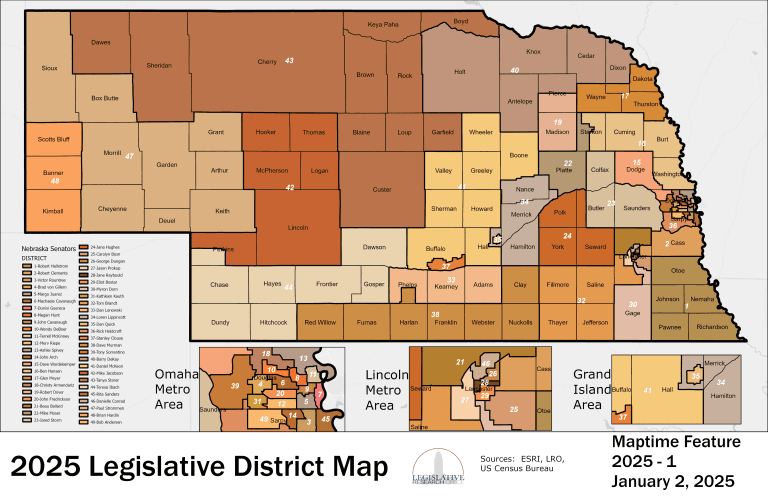

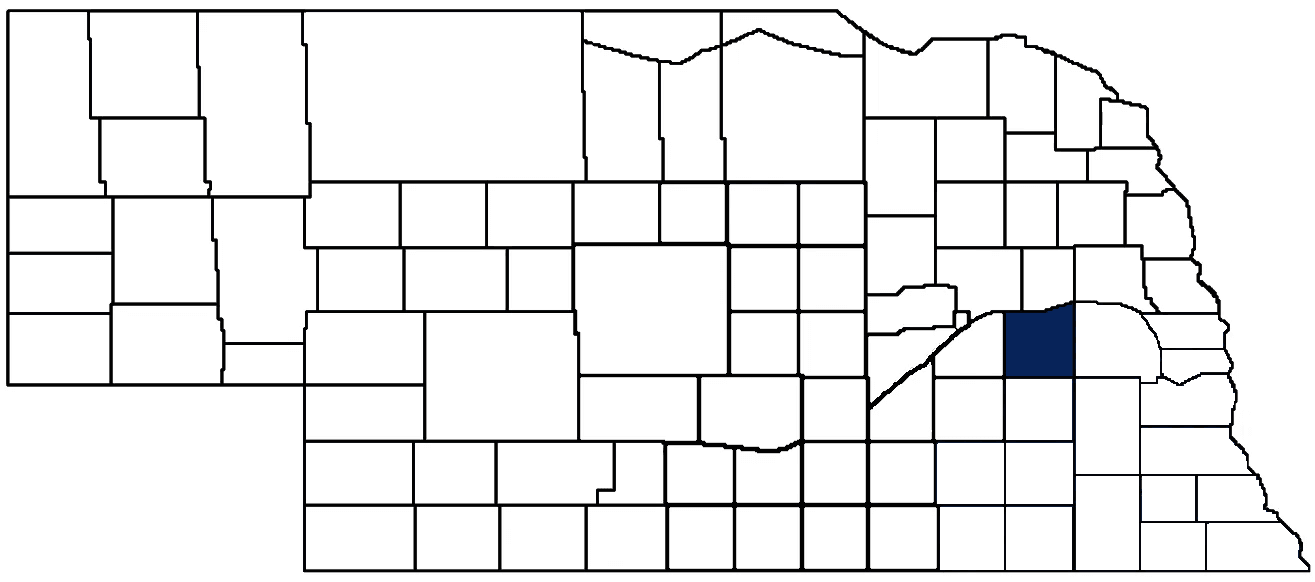

State Senator: Jared Storm (District 23)

Committees: Agriculture, General Affairs, Judiciary

Map and statistics for Legislative District 23

State Senator: Jana Hughes (District 24)

Committees: Education, Natural Resources, Building Maintenance, Education Commission of the States, Midwestern Higher Education Compact Commission

Map and statistics for Legislative District 24

Map of all districts in the Nebraska Unicameral Legislature

Butler County History

Number of Registered Historic Places: 13

Year Authorized: 1856

Year Organized: 1868

Etymology: William Butler (U.S. Congressman)

Butler County boasts a history that spans over several centuries. The county was originally home to several Native American tribes, including the Omaha, Pawnee, and Winnebago. In 1847, the Waverly Town Company began settling the area near Linwood, which was near the site of an ancient Pawnee village. In fact, Skull Creek was named for the numerous human skulls discovered during construction of an early white settlement in the area.

Although the Legislature defined Butler County’s boundaries in 1856, it was only until 1868 that the county was formally organized. The origin of Butler County’s name is somewhat disputed. Some claim the county was named after Nebraska governor David Butler, while the predominant argument suggests that the county’s namesake was William Butler, a U.S. Congressman who declined an appointment to become Nebraska’s first governor (the honor would pass to Francis Burt—the namesake of Burt County—who died after only two days in office).

Soon after the county’s organization, the population rapidly climbed from only a couple of hundred residents to over 2,500. Like many other counties in eastern Nebraska, Butler County’s fertile soil and strong potential for agriculture drew thousands of homesteaders. By 1890, the population had grown from 27 settlers in 1860 to more than 15,000, due in no small part to the railroad.

Savannah was the original county seat, but its northern location left residents seeking a more central location. David City emerged victorious from a multi-year series of bitter elections and seized the county seat from Savannah. Though the site of David City lacked the existing infrastructure of Savannah, it sprang up fast on the prairie and became home to over 2,000 residents by 1880, foreshadowing the growth of the county over the next several decades.

Highlight an important program from your county in this space! Send an email to:

Local Highlights

License Plate Number: 25

Time Zone: Central

Number of Veterans: 484 2024

Zoned County: No

County Hospital: Butler County Health Care Center

Number of County-Owned Bridges: 173

Number of County-Owned Dams: 3

Election Data

Voter Turnout: 81% 2024

Number of Registered Voters: 5,741 2024

Number of Precincts: 11 2022

Number of Election Day Polling Places: 7 2022

Land Area per Polling Place: 84.40 sq. miles

Intergovernmental Data

Emergency Mgt. Planning, Exercise and Training (PET) Region: East Central

Natural Resource Districts: Lower Loup NRD, Lower Platte North NRD, Lower Platte South NRD, Upper Big Blue NRD

State Lands (acres): Redtail WMA (320)

Sources: Nebraska Department of Transportation, Nebraska Emergency Management Agency, Nebraska Game & Parks Commission, Nebraska Legislature, Nebraska Office of the CIO, Nebraska Secretary of State, U.S. Department of Veterans Affairs, U.S. Election Assistance Commission, U.S. National Archives and Records Administration (eCFR)