- General Info

- Demographics

- Education and Employment

- Valuation and Taxes Levied

- State Senators

- History

- County Programs

- Other Information

Communities and Development

Johnson County Seat: Tecumseh

Total County Population: 5,290

- Cities (pop. & class): Tecumseh (1,694 • 2nd Class)

- Villages (pop.): Cook (319), Crab Orchard (46), Elk Creek (69), Sterling (480)

- Unincorporated Pop. (% of county pop.): 2,682 (51%) 2020

Land Development (% of total land in county):

- Agriculture: 81%

- By method: Dryland (row crop/grain/forage) (44%); Pasture (pure grassland) (26%); Irrigated (row crop/grain/forage) (11%) • Neb. Dept. of Rev. - total equals agriculture's %

- By commodity: Soybeans 28%, Livestock (grassland) 27%, Corn 26%, Other Hay 2%, Alfalfa 1% • USDA - equals agriculture's % minus public grassland/wetlands and reserve

- Residential, Commercial, Industrial, Conservation Reserve & Exempt (combined): 11%

- Timber: 6% 2022

County Offices

Courthouse Address and Hours:

351 Broadway

Tecumseh, Nebraska 68450

M-F 8:00 am - 12:30; 1:00 pm - 4:30 pm

Complete list of county board members

County Board Meetings: Every other Tuesday

View the County's Government Maps

NACO District: Southeast

General

Population: 5,290

Land area (sq. mi.): 376.08

Population per square mile: 14.1

Race & Age

Race 2020

White: 77.5%

African American: 5.9%

American Indian: 1.0%

Asian: 1.4%

Hispanic: 11.9%

Native Hawaiian and Pacific Islander: 0.0%

Two or More Races: 2.1%

Age 2020

0-17: 19.2%

18-64: 65.1%

65+: 19.2%

Households

Total households: 1,797 2020

With one child: 210 2022

With 2+ children: 280 2022

With seniors (65+): 530 2022

Socioeconomics

Median household income: $59,457 2023

% of Population in Poverty: 13.4% 2023

# of Housing Units: 2,093 2020

Owner-occupied rate: 72.6% 2020

Median home price: $142,250 Q4 2024

2024 building permits for detached single family homes: 4

2024 building permits for non-detached housing units: 0 (townhouse, duplex, or apt. unit)

Technology

Access to broadband (100 Mbps via fiber or cable modem): 49.6% 2021

Sources: National Association of Realtors, Nebraska Department of Revenue, Nebraska Legislature, Nebraska Library Commission, U.S. Bureau of Economic Analysis, U.S. Census Bureau (building permits), U.S. Census Bureau (demographics), U.S. Census Bureau (municipalities)

Employment, Schools, and Child Care

Unemployment rate: 3.9% Sept. 2024

County Employment Website: https://nebraskacounties.org/nebraska-counties/county-employment-opportunities.html

High school graduate or higher: 87.6% 2020

Bachelor's degree or higher: 18.7% 2020

School Districts: Freeman Public Schools, Humboldt Table Rock Steinauer, Johnson-Brock Public Schools, Johnson County Central Public Schools, Lewiston Consolidated Schools, Sterling Public Schools, Syracuse-Dunbar-Avoca Schools

Countywide child care capacity: 5 providers; 93 children 2024

Find child care: For a list of child care providers in your zip code, visit Nebraska DHHS or the Nebraska Resource and Referral System.

Johnson County Economy

Annual Gross Domestic Product (GDP): $266,350,000 2023

Nonfarm Small Business Receipts: $30,619,415 2022

Nonfarm Wage Income: $86,737,000 2022

Farm and Ranch Commodity Sales Receipts: $85,275,000 2022

Farm and Ranch Operations (Non-Sales) Receipts: $7,073,000 2022

- For components of nonfarm small business receipts, nonfarm wage income, and farm & ranch commodity sales and operations receipts, see "Notes" below.

Grain Elevators by Location (bushels capacity):

- Cook: Frontier (175,384)

- Elk Creek: Frontier (283,366)

- St. Mary: Frontier (470,571)

- Sterling: Farmers (909,884)

- Tecumseh: Frontier (1,342,487), Frontier (1,472,192)

- (1 bushel = 56 lbs. corn/sorghum, 60 lbs. soybeans/wheat; % max. moisture = 18% beans, 15.5% corn, 14% sorghum/soybeans, 13.5% wheat)

Railroad Miles: 25.78 main, 5.58 side

- Places with Railroad Service: Elk Creek, St. Mary, Sterling, Tecumseh

Local Grain Market: Click for today's grain prices in Johnson County

Cattle Producers: 178

- Pastureland Cash Rent (avg.): $51/acre 2024

Crop Producers: 107

- Dryland Cash Rent (avg.): $185/acre 2024

- Irrigated Land Cash Rent (avg.): $297/acre 2024

Electricity Providers: Auburn Board of Public Works, City of Tecumseh, Nebraska PPD, Omaha PPD

Irrigation and Drinking Water

Rural Irrigation Wells: 290 2024

Rural Livestock Wells: 33 2024

Rural Commercial/Industrial Wells: 6 2024

Rural Drinking Water Wells: 117 2024

Drinking Water Utility Connections: 1,714 Residential; 297 Commercial; 0 Industrial 2024

Surface Water Diversions (Irrigation): 144 2024

Notes

Johnson County Economy

- Nonfarm small business receipts are reported by partnerships and sole proprietorships. They do not include receipts reported by cooperative associations.

- Nonfarm wage income is reported based upon the wage earner's residential address; therefore, it also includes wages earned by Johnson County residents in other counties or states, but it excludes wages earned in Johnson County by residents of other counties or states.

- Nonfarm wage income excludes wages earned by anyone claimed as a dependent.

- Farm and ranch commodity sales receipts and operations receipts are reported based upon the farm or ranch owner's principal county of operations; therefore, those figures also include receipts reported by producers operating principally in Johnson County for their production in other counties or states, but the figures exclude receipts reported for production in Johnson County by producers operating principally in other counties or states.

Irrigation and Drinking Water

- A rural irrigation well is any well intended for irrigating crops that, either on its own or as part of a set of commingled wells, is capable of pumping more than fifty (50) gallons of water per minute (gpm). Note that some rural commercial/industrial wells are also capable of pumping more than 50 gpm. In Nebraska, the owner of any well--or set of commingled wells--that is capable of pumping more than 50 gpm must register the well(s) with the state government and have a permit for the well(s) from the local natural resource district (NRD).

- Rural livestock wells and rural drinking water (also known as "domestic") wells are not allowed to pump more than 50 gpm unless permitted by the local NRD. Each rural drinking water well usually serves one single family home, though in rare cases a rural drinking water well serves multiple homes.

- Data on rural livestock wells and rural drinking water wells may be incomplete for wells drilled prior to September 9, 1993. State law does not require wells drilled prior to that date to be registered with the state government if the wells are not capable of pumping more than 50 gpm. Neb. Rev. Stat. § 46-735; see Laws 1993, LB 131, § 25.

Sources: National Agricultural Statistics Service (USDA), Nebraska Cooperative Council, Nebraska Coordinating Commission for Postsecondary Education, Nebraska Department of Health and Human Services, Nebraska Department of Revenue, Nebraska Department of Transportation, Nebraska Office of the CIO, Nebraska Power Review Board, Nebraska Public Service Commission, U.S. Bureau of Economic Analysis, U.S. Bureau of Labor Statistics, U.S. Census Bureau, U.S. Energy Information Administration, U.S. Department of the Treasury (IRS), Warehouse and Commodity Management Division (USDA)

2024 Levies and Valuation

County levy rate: $0.2727 per $100 of taxable valuation

County property taxes levied: $3,210,513

Total local government property taxes levied: $15,562,667

Total countywide taxable valuation: $1,177,456,807

Click here for all levy rates in Johnson County

County Levy and Taxation Laws

Levy limits

Since 1996, counties and other political subdivisions have been subject to the levy limits listed in Neb. Rev. Stat. § 77-3442 and Neb. Rev. Stat. § 77-3443.

Statutes and regulations

Nebraska Revised Statutes (Chapter 77)

Nebraska Administrative Code (Title 350)

Local tax reductions, exemptions, and credits

Neb. Rev. Stat. § 76-902(5)(a) (Deed "stamp tax" exemption): "The [stamp tax] shall not apply to: ... (5)(a) Deeds between spouses, between ex-spouses for the purpose of conveying any rights to property acquired or held during the marriage, or between parent and child, without actual consideration therefor."

Neb. Rev. Stat. § 77-201(2) (Valuation of agricultural land and horticultural land): "Agricultural land and horticultural land as defined in section 77-1359 shall constitute a separate and distinct class of property for purposes of property taxation, shall be subject to taxation, unless expressly exempt from taxation, and shall be valued at seventy-five percent of its actual value, except that for school district taxes levied to pay the principal and interest on bonds that are approved by a vote of the people on or after January 1, 2022, such land shall be valued at fifty percent of its actual value."

Neb. Rev. Stat. § 77-6703(1) (Tax credit for school district taxes paid): "(1) For taxable years beginning or deemed to begin on or after January 1, 2020, under the Internal Revenue Code of 1986, as amended, there shall be allowed to each eligible taxpayer a refundable credit against the income tax imposed by the Nebraska Revenue Act of 1967 or against the franchise tax imposed by sections 77-3801 to 77-3807. The credit shall be equal to the credit percentage for the taxable year, as set by the department under subsection (2) of this section, multiplied by the amount of school district taxes paid by the eligible taxpayer during such taxable year."

Sources: Nebraska Department of Revenue

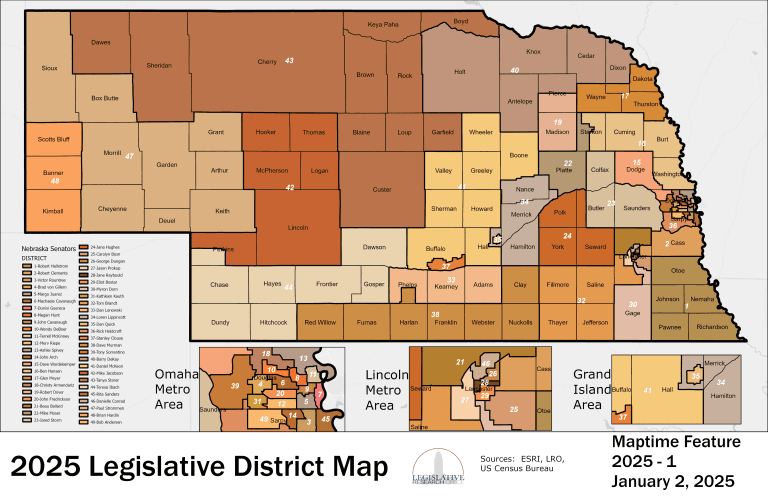

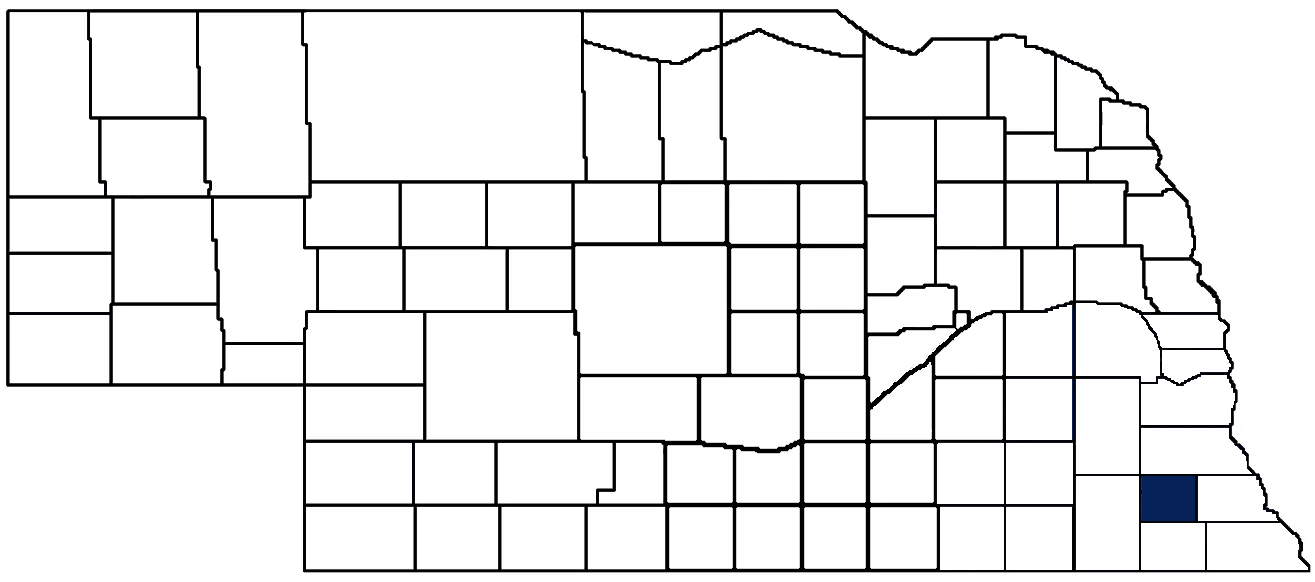

State Senator: Robert Hallstrom (District 1)

Committees

Map and statistics for Legislative District 1

Map of all districts in the Nebraska Unicameral Legislature

Johnson County History

Number of Registered Historic Places: 14

Year Authorized: 1855

Year Organized: 1857

Etymology: Richard Johnson (U.S. vice president)

The early pioneers of Johnson County braved numerous challenges in those first few years, most notably bitter winters, massive snowdrifts, and isolation from the nearest town many miles away. The early European settlers were undaunted, and roads began spreading through the county, connecting early outposts and communities.

In 1857, the Nebraska Legislature partitioned Nemaha County, creating Johnson County from the western half. The county was named after Richard M. Johnson, who fought in the War of 1812 and later served one term as Vice President. It was reported but never verified that Johnson killed the Shawnee chief Tecumseh during the Battle of the Thames during the war; the Johnson County seat of Tecumseh is named after the Native American warrior.

Between 1860 and 1900, the county gained over ten thousand residents, mostly farmers drawn to the area by its three feet of top soil, numerous streams, abundant well water, and timber; its agriculture production per acre rivals any Nebraska county. Yet what lies beneath the surface may be equally valuable as what grows above it. Johnson County boasts some of the country’s largest deposits of rare earth elements used to produce high-strength alloys.

Today, the Johnson County Historical Society preserves the rich history of the county, including one of the original jails and schoolhouses, a historical Christian church, Native American artifacts and pottery from as far back as 1200, antique glass and dishware, and the story of Tecumseh native Charles O. Gardner, who became internationally known for developing high yield corn seed and genetic research in agronomy.

Highlight an important program in your county in this space! Send an email to:

Local Highlights

License Plate Number: 57

Time Zone: Central

Zoned County: Yes

Number of Veterans: 302 2023

County Hospital: Johnson County Hospital

Number of County-Owned Bridges: 140

Number of County-Owned Dams: 1

Election Data

General Election Turnout: 59% 2024

Total Registered Voters: 2,849 2024

Number of Precincts: 6 2022

Number of Election Day Polling Places: 6 2022

Land Area per Polling Place (avg.): 62.79 sq. miles

Intergovernmental Data

Emergency Mgt. Planning, Exercise and Training (PET) Region: Southeast

Natural Resource District: Nemaha NRD

State Lands (acres): Hickory Ridge WMA (564.20), James N. Douglas WMA (1,118.31), Osage WMA (777.86)

Sources: Nebraska Department of Transportation, Nebraska Emergency Management Agency, Nebraska Game & Parks Commission, Nebraska Legislature, Nebraska Office of the CIO, Nebraska Secretary of State, U.S. Department of Veterans Affairs, U.S. Election Assistance Commission, U.S. National Archives and Records Administration (eCFR)