- General Info

- Demographics

- Education and Employment

- Valuation and Taxes Levied

- State Senators

- History

- County Programs

- Other Information

Communities and Development

Wheeler County Seat: Bartlett

Total County Population: 774

- Villages (pop.): Bartlett (109), Ericson (89)

- Unincorporated Pop. (% of county pop.): 576 (74%) 2020

Land Development (% of total land in county):

- Agriculture: 95%

- By method: Pasture (pure grassland) (77%); Irrigated (row crop/grain/forage) (17%); Dryland (row crop/grain/forage) (1%) • Neb. Dept. of Rev. - total equals agriculture's %

- By commodity: Livestock (grassland) 74%, Corn 10%, Soybeans 6%, Alfalfa 1% • USDA - equals agriculture's % plus some wetlands (5%) and minus public grassland/wetlands and reserve

- Residential, Commercial, Industrial, Conservation Reserve & Exempt (combined): 5% 2022

County Offices

Courthouse Address and Hours:

301 3rd St

Bartlett NE 68622

M-Th 9:00 am - 5:00 pm (open over noon hour)

Fri 9:00 am - 12:00 pm

Complete list of county board members

County Board Meetings: Last Wednesday

View the County's Government Maps

NACO District: Central

General

Population: 774

Land area (sq. mi.): 575.18

Population per square mile: 1.3

Race and Age

Race 2020

White: 95.1%

African American: 0.0%

American Indian: 0.3%

Asian: 0.0%

Hispanic: 2.6%

Native Hawaiian and Pacific Islander: 0.0%

Two or More Races: 1.9%

Age 2020

0-17: 21.9%

18-64: 49.7%

65+: 28.4%

Households

Total households: 343 2020

With one child: 30 2022

With 2+ children: 50 2022

With seniors (65+): 100 2022

Socioeconomics

Median household income: $55,893 2023

% of Population in Poverty: 14.7% 2023

# of Housing Units: 503 2020

Owner-occupied rate: 73.2% 2020

Median home price: $147,010 Q4 2024

2024 building permits for detached single family homes: 2

2024 building permits for non-detached housing units: 0 (townhouse, duplex, or apt. unit)

Technology

Access to broadband (100 Mbps via fiber or cable modem): 65.8% 2021

Sources: National Association of Realtors, Nebraska Department of Revenue, Nebraska Legislature, Nebraska Library Commission, U.S. Bureau of Economic Analysis, U.S. Census Bureau (building permits), U.S. Census Bureau (demographics), U.S. Census Bureau (municipalities)

Employment, Education, and Child Care

Unemployment rate: 2.6% March 2025

County Employment Website: https://wheelercounty.ne.gov/webpages/links/public_notices.html

High school graduate or higher: 95.6% 2020

School Districts: Chambers Public Schools, Elgin Public Schools, Riverside Public Schools, Wheeler Central Schools

Bachelor's degree or higher: 25.1% 2020

Community College Service Area: Northeast Community College

Countywide child care capacity: 2 providers; 24 children 2024

Find child care: For a list of child care providers in your zip code, visit Nebraska DHHS or the Nebraska Resource and Referral System.

Wheeler County Economy

Annual Gross Domestic Product (GDP): $129,269,000 2023

Nonfarm Small Business Receipts: $6,110,240 2022

Nonfarm Wage Income: $12,733,000 2022

Farm and Ranch Commodity Sales Receipts: $358,865,000 2022

Farm and Ranch Operations (Non-Sales) Receipts: $6,016,000 2022

- For components of nonfarm small business receipts, nonfarm wage income, and farm & ranch commodity sales and operations receipts, see "Notes" below.

Local Grain Market: Click for today's grain prices in Wheeler County

Cattle Producers: 132

- Pastureland Cash Rent (avg.): $36/acre 2024

Crop Producers: 78

- Dryland Cash Rent (avg.): $75/acre 2024

- Irrigated Land Cash Rent (avg.): $242/acre 2024

Electricity Providers: Elkhorn Rural PPD, Loup Valleys Rural PPD, Niobrara Valley Electric Member Corp.

Wind Turbines Operating (MW): 29 turbines (80,220 MW total)

Irrigation and Drinking Water

Rural Irrigation Wells: 637 2024

Rural Livestock Wells: 291 2024

Rural Commercial/Industrial Wells: 0 2024

Rural Drinking Water Wells: 94 2024

Drinking Water Utility Connections: 130 Residential; 0 Commercial; 0 Industrial 2024

Surface Water Diversions (Irrigation): 9 2024

Click for real time:

Groundwater level data near 836th Rd. & 501 Ave. (6.5 mi. northeast of Bartett)

Notes

Wheeler County Economy

- Nonfarm small business receipts are reported by partnerships and sole proprietorships. They do not include receipts reported by cooperative associations.

- Nonfarm wage income is reported based upon the wage earner's residential address; therefore, it also includes wages earned by Wheeler County residents in other counties or states, but it excludes wages earned in Wheeler County by residents of other counties or states.

- Nonfarm wage income excludes wages earned by anyone claimed as a dependent.

- Farm and ranch commodity sales receipts and operations receipts are reported based upon the farm or ranch owner's principal county of operations; therefore, those figures also include receipts reported by producers operating principally in Wheeler County for their production in other counties or states, but the figures exclude receipts reported for production in Wheeler County by producers operating principally in other counties or states.

Irrigation and Drinking Water

- A rural irrigation well is any well intended for irrigating crops that, either on its own or as part of a set of commingled wells, is capable of pumping more than fifty (50) gallons of water per minute (gpm). Note that some rural commercial/industrial wells are also capable of pumping more than 50 gpm. In Nebraska, the owner of any well--or set of commingled wells--that is capable of pumping more than 50 gpm must register the well(s) with the state government and have a permit for the well(s) from the local natural resource district (NRD).

- Rural livestock wells and rural drinking water (also known as "domestic") wells are not allowed to pump more than 50 gpm unless permitted by the local NRD. Each rural drinking water well usually serves one single family home, though in rare cases a rural drinking water well serves multiple homes.

- Data on rural livestock wells and rural drinking water wells may be incomplete for wells drilled prior to September 9, 1993. State law does not require wells drilled prior to that date to be registered with the state government if the wells are not capable of pumping more than 50 gpm. Neb. Rev. Stat. § 46-735; see Laws 1993, LB 131, § 25.

Sources: National Agricultural Statistics Service (USDA), Nebraska Cooperative Council, Nebraska Coordinating Commission for Postsecondary Education, Nebraska Department of Health and Human Services, Nebraska Department of Revenue, Nebraska Department of Transportation, Nebraska Office of the CIO, Nebraska Power Review Board, Nebraska Public Service Commission, U.S. Bureau of Economic Analysis, U.S. Bureau of Labor Statistics, U.S. Census Bureau, U.S. Energy Information Administration, U.S. Department of the Treasury (IRS), Warehouse and Commodity Management Division (USDA)

2024 Levies and Valuation

County levy rate: $0.2661 per $100 of taxable valuation

County property taxes levied: $1,975,527

Total local government property taxes levied: $6,791,543

Total countywide taxable valuation: $742,279,099

Click here for all levy rates in Wheeler County

County Levy and Taxation Laws

Levy limits

Since 1996, counties and other political subdivisions have been subject to levy limits under Neb. Rev. Stat. § 77-3442 and Neb. Rev. Stat. § 77-3443.

Statutes and regulations

Nebraska Revised Statutes (Chapter 77)

Nebraska Administrative Code (Title 350)

Local tax reductions, exemptions, and credits

Neb. Rev. Stat. § 76-902(5)(a) (Deed "stamp tax" exemption): "The [stamp tax] shall not apply to: ... (5)(a) Deeds between spouses, between ex-spouses for the purpose of conveying any rights to property acquired or held during the marriage, or between parent and child, without actual consideration therefor."

Neb. Rev. Stat. § 77-201(2) (Valuation of agricultural land and horticultural land): "Agricultural land and horticultural land as defined in section 77-1359 shall constitute a separate and distinct class of property for purposes of property taxation, shall be subject to taxation, unless expressly exempt from taxation, and shall be valued at seventy-five percent of its actual value, except that for school district taxes levied to pay the principal and interest on bonds that are approved by a vote of the people on or after January 1, 2022, such land shall be valued at fifty percent of its actual value."

Neb. Rev. Stat. § 77-6703(1) (Tax credit for school district taxes paid): "(1) For taxable years beginning or deemed to begin on or after January 1, 2020, under the Internal Revenue Code of 1986, as amended, there shall be allowed to each eligible taxpayer a refundable credit against the income tax imposed by the Nebraska Revenue Act of 1967 or against the franchise tax imposed by sections 77-3801 to 77-3807. The credit shall be equal to the credit percentage for the taxable year, as set by the department under subsection (2) of this section, multiplied by the amount of school district taxes paid by the eligible taxpayer during such taxable year."

Sources: Nebraska Department of Revenue

State Senator: Daniel D. McKeon (District 41)

Committees

- Agriculture

- Business and Labor

- Government, Military and Veterans Affairs

- Building Maintenance

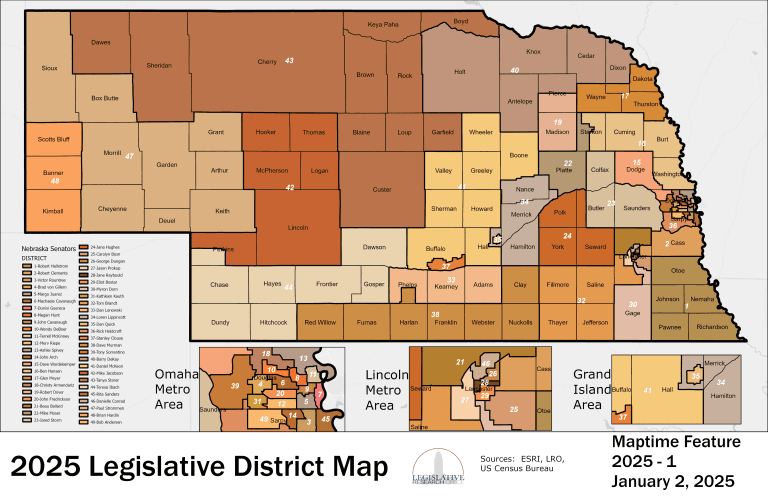

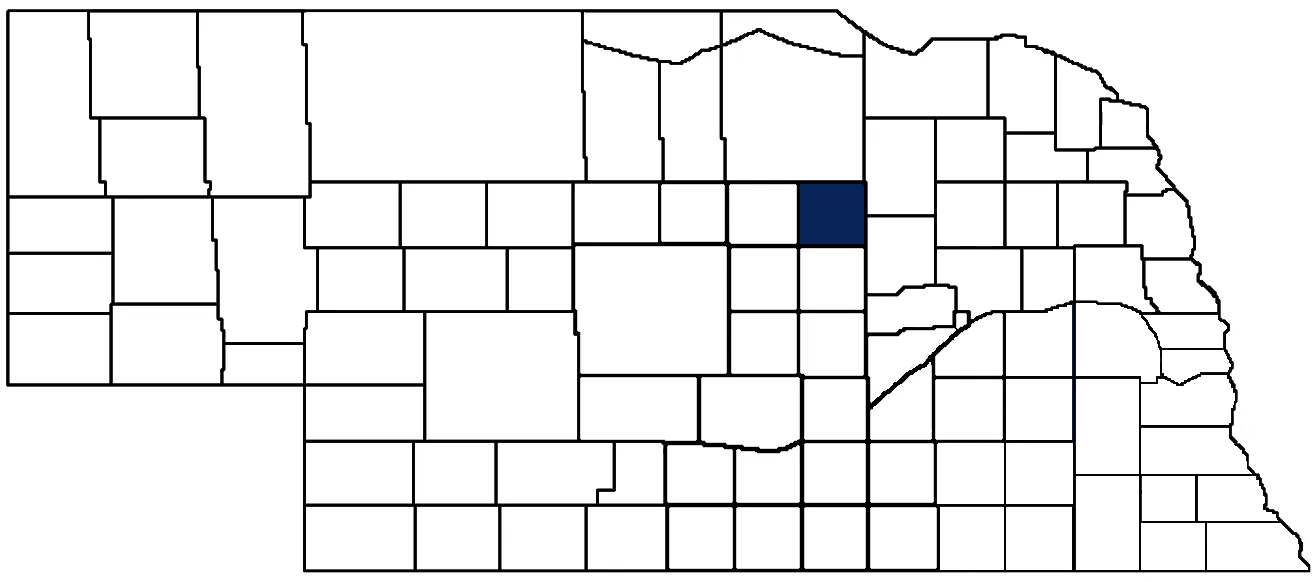

Map and statistics for Legislative District 41

Map of all districts in the Nebraska Unicameral Legislature

Wheeler County History

Number of Registered Historic Places: 2

Year Authorized: 1877

Year Organized: 1881

Etymology: Daniel Wheeler (Nebraska State Board of Agriculture Secretary)

On Feb. 17, 1877, the boundaries of Wheeler County were established by the Legislature and named the new county in honor of Maj. Daniel H. Wheeler, a long-time secretary of the Nebraska State Board of Agriculture. It would be four years later, however, that the county would officially organize.

Gov. Albinus Nance appointed a special board of commissioners and a county clerk who would be responsible for the organization efforts. At the time the county was being organized it included the area that is today neighboring Garfield County to the west. The commissioners agreed to meet at a county seat known as Cedar City because it was a central location. Cedar City, so named because three large cedar trees stood there, was located approximately six miles north of the present town of Ericson.

In 1881 residents in the western half of the county proposed their area should become a separate county and in November of that year Wheeler County was divided.

The question of where Wheeler County should locate its government offices became an important topic in 1885. Cumminsville, the first townsite in the county, sought the honor. So too did an area just south of where Bartlett is located today. The Bartlett site offered several incentives, including land on which to build a courthouse. After two special elections, Bartlett was selected over Cumminsville by a vote of 193 to 90.

A modest courthouse was soon built in Bartlett. A fire-proof brick vault was built in Ericson to hold valuable county records. This decision proved to be wise, as in 1909 the courthouse was destroyed by fire. Ericson made an effort to relocate the county seat there. But in a special election, voters rejected the idea and instead approved a $5,000 expenditure to replace the courthouse. This structure was completed in 1920.

In 1976 the courthouse building was condemned by the State Fire Marshal. Concerned citizens began efforts to replace it. After more than six years of study, the present courthouse was completed in May 1982.

Highlight an important program in your county in this space! Send an email to:

Local Highlights

License Plate Number: 84

Time Zone: Central

Zoned County: Yes

Number of Veterans: 33 2023

Number of County-Owned Bridges: 9

Number of County-Owned Dams: 0

Election Data

General Election Turnout: 62% 2024

Total Registered Voters: 613 2024

Number of Precincts: 2 2022

Number of Election Day Polling Places: 2 2022

Land Area per Polling Place (avg.): 287.59 sq. miles

Intergovernmental Data

Emergency Mgt. Planning, Exercise and Training (PET) Region: North Central/Sandhills

Sources: Nebraska Department of Transportation, Nebraska Emergency Management Agency, Nebraska Game & Parks Commission, Nebraska Legislature, Nebraska Office of the CIO, Nebraska Secretary of State, U.S. Department of Veterans Affairs, U.S. Election Assistance Commission, U.S. National Archives and Records Administration (eCFR)